The following is a guest post from reader Dan, who shares his story of starting Maciverse.com and developing it to where it earns $1,500 in passive income each month.

In January of 2008 I closed shop on my first attempt at blogging. Six months earlier I thought that creating a blog about efforts to train for my first marathon would be extremely successful. It didn’t take me long to realize that the only thing more boring than writing about running is reading about someone Else’s runs. When I shut the doors on 26miles385yards.com I wasn’t giving up on blogging, I was giving up my blogging about topics that no one wanted to read.

In January of 2008 I closed shop on my first attempt at blogging. Six months earlier I thought that creating a blog about efforts to train for my first marathon would be extremely successful. It didn’t take me long to realize that the only thing more boring than writing about running is reading about someone Else’s runs. When I shut the doors on 26miles385yards.com I wasn’t giving up on blogging, I was giving up my blogging about topics that no one wanted to read.

It was also in January of 2008 that I launched Maciverse.com, a Mac Help blog. I’ll admit that I was late to market with the whole Apple blogging idea but I believed I had a bit of a different take on Apple computers and felt that I could fill a niche.

It was 6 months after Apple released their first iPhone and there was significant talk from media outlets and financial advisers about how they were anticipating a significant “halo” affect from iPhone and iPod sales into Mac computers. The more I heard this idea, the more I realized that there would be a growing audience of individuals looking for help with use of their new computer. Just a few years earlier I purchased my first Apple computer and had quickly fallen in love with the products the company built. There was a learning curve but I was picking up use of the Mac quickly and found myself sharing tips with even the most experienced Apple product owners. So I decided to create Maciverse as a site where I shared my tips to the new Mac user.

Maciverse didn’t explode overnight, but through steady and consistent effort the site has grown from just a handful of visitors each month to over 1 million visitors each year It continues to increase in size by about 20% each month without a single dollar spent on advertising. We now cover more than just hints and tips for your Mac and have grown to a team of 5 authors sharing everything the know, love, and sometimes hate about Apple products.

With the traffic growth has also come residual income. but in reality, for the first year Maciverse didn’t make more than $100. My first check from Google Adsense came in year 2 and at that time I was just happy to be breaking even. But over the last 12 months Maciverse has gone from making just a few dollars a month to continual earnings of over $1500 a month. Increasing the number of visitors to the site has helped with the financial gains, but the biggest reason I wasn’t always making decent income from Maciverse was because I didn’t know how to monetize my audience. Below is what I’ve learned about monetizing a Mac site.

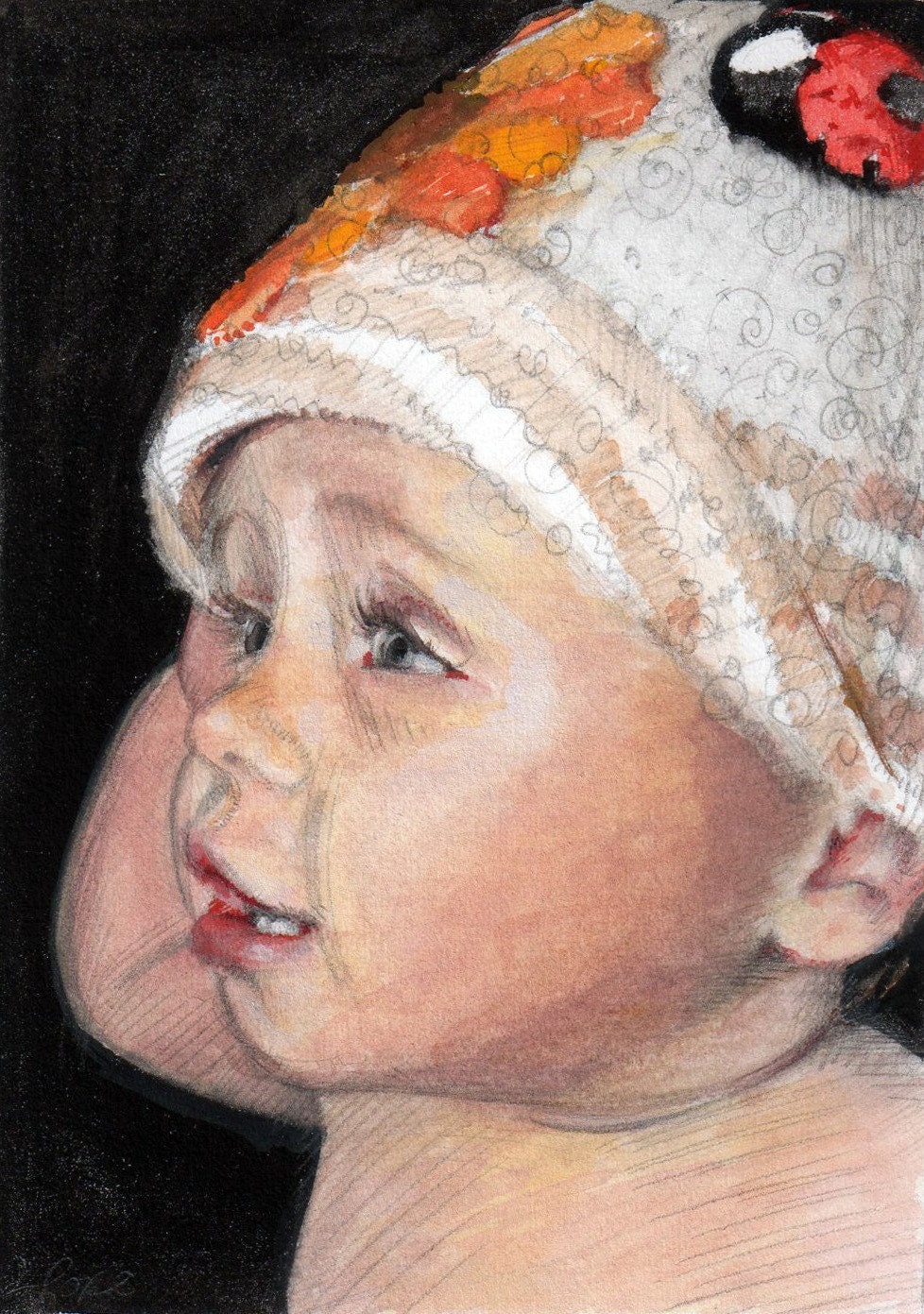

As a thirty-five year old mother of three, for the past decade I have been fully employed as a stay at home mom. When my first child was born I put my career aspirations and four year college degree aside to focus on raising our children. Before motherhood, I used to work as a graphic artist doing on-air graphics for a local TV station and a national satellite TV provider. Now that all the kids are all in school, with encouragement from friends and family, I recently started my own home based graphic art and design business. This is the story – or at least the first chapter – in a story which just began to be written about my home based business.

As a thirty-five year old mother of three, for the past decade I have been fully employed as a stay at home mom. When my first child was born I put my career aspirations and four year college degree aside to focus on raising our children. Before motherhood, I used to work as a graphic artist doing on-air graphics for a local TV station and a national satellite TV provider. Now that all the kids are all in school, with encouragement from friends and family, I recently started my own home based graphic art and design business. This is the story – or at least the first chapter – in a story which just began to be written about my home based business.  A couple weeks ago, I was looking to

A couple weeks ago, I was looking to  Sterling silver chain bracelet, Pandora style [

Sterling silver chain bracelet, Pandora style [

“Abandoned Fender Electric Piano” photo print [

“Abandoned Fender Electric Piano” photo print [ Garnet Briolette Oval Lace Earrings [

Garnet Briolette Oval Lace Earrings [

Natural Lavender Soap with Shea Butter & Oatmeal [krugsecologic]

Natural Lavender Soap with Shea Butter & Oatmeal [krugsecologic]

[

[

I received a snail-mail postcard that advertised up to 30% off certain FedEx Express shipping services, and 10% off FedEx Ground until May 31st, 2009. After that, you’ll still get either 16% or 8% off eligible services. Seems like a potentially useful offer for those with eBay businesses, online shops, or other shipping needs.

I received a snail-mail postcard that advertised up to 30% off certain FedEx Express shipping services, and 10% off FedEx Ground until May 31st, 2009. After that, you’ll still get either 16% or 8% off eligible services. Seems like a potentially useful offer for those with eBay businesses, online shops, or other shipping needs. The Best Credit Card Bonus Offers – 2025

The Best Credit Card Bonus Offers – 2025 Big List of Free Stocks from Brokerage Apps

Big List of Free Stocks from Brokerage Apps Best Interest Rates on Cash - 2025

Best Interest Rates on Cash - 2025 Free Credit Scores x 3 + Free Credit Monitoring

Free Credit Scores x 3 + Free Credit Monitoring Best No Fee 0% APR Balance Transfer Offers

Best No Fee 0% APR Balance Transfer Offers Little-Known Cellular Data Plans That Can Save Big Money

Little-Known Cellular Data Plans That Can Save Big Money How To Haggle Your Cable or Direct TV Bill

How To Haggle Your Cable or Direct TV Bill Big List of Free Consumer Data Reports (Credit, Rent, Work)

Big List of Free Consumer Data Reports (Credit, Rent, Work)