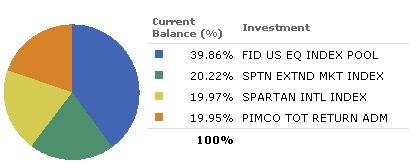

My goal for last month was to implement my chosen asset allocation plan. Here is my current status:

1) My E*Trade Traditional IRA is liquidated and transferred to a Vanguard Traditional IRA where it is currently invested in VTTHX. I am going to consider rolling it over to the Roth IRA.

2) My $7,000 Roth Contributions ($3k 2004/$4k 2005) are invested in a Vanguard Roth IRA in VTTHX, along with

3) My Ameritrade Roth IRA (previously cash) which is also transferred to the Vanguard Roth IRA.

[Read more…]

The Best Credit Card Bonus Offers – 2025

The Best Credit Card Bonus Offers – 2025 Big List of Free Stocks from Brokerage Apps

Big List of Free Stocks from Brokerage Apps Best Interest Rates on Cash - 2025

Best Interest Rates on Cash - 2025 Free Credit Scores x 3 + Free Credit Monitoring

Free Credit Scores x 3 + Free Credit Monitoring Best No Fee 0% APR Balance Transfer Offers

Best No Fee 0% APR Balance Transfer Offers Little-Known Cellular Data Plans That Can Save Big Money

Little-Known Cellular Data Plans That Can Save Big Money How To Haggle Your Cable or Direct TV Bill

How To Haggle Your Cable or Direct TV Bill Big List of Free Consumer Data Reports (Credit, Rent, Work)

Big List of Free Consumer Data Reports (Credit, Rent, Work)